Planning your Retirement: The Benefits of Fee-Only Retirement Advice

Planning your Retirement: The Benefits of Fee-Only Retirement Advice

Heading 1: Why Retirement Planning is Essential

Planning for retirement is a crucial step in securing your financial future. It involves setting aside sufficient funds to support yourself during your golden years, ensuring a comfortable and stress-free lifestyle. However, retirement planning can be daunting and complex, especially if you are unsure of the best strategies to adopt.

Heading 2: The Importance of Professional Retirement Advice

Navigating the complexities of retirement planning requires expertise and knowledge. Seeking professional retirement advice can provide you with the guidance necessary to make informed decisions. By working with experienced financial advisors, you can gain access to their expertise in financial planning, investment management, and wealth preservation.

Heading 3: Fee-Only Retirement Advice: What is it?

Fee-only retirement advice refers to a model of financial advisory where advisors are compensated solely by their clients and do not receive commissions from financial product sales. This means that their recommendations are not biased by any potential kickbacks or incentives from financial institutions. Fee-only advisors are fiduciaries and are legally obligated to act in their clients’ best interests, offering objective and unbiased advice.

Heading 4: The Benefits of Fee-Only Retirement Advice

4.1 Objective and Unbiased Recommendations

When seeking fee-only retirement advice, you can be confident that the advice you receive is solely in your best interest. Fee-only advisors have no financial interest in recommending specific products, allowing them to provide unbiased advice tailored to your unique financial goals and circumstances. This ensures that you receive recommendations that prioritize your needs and maximize your retirement savings.

4.2 Transparent and Easy-to-Understand Pricing

Fee-only advisors operate on a transparent pricing model, clearly outlining their fees upfront. This eliminates any potential surprises or hidden costs, ensuring that you have a clear understanding of the charges involved. Moreover, fee-only advisors often provide services on a fee-for-service or hourly basis, allowing you to control the duration and cost of your engagement.

4.3 Comprehensive Financial Planning

Fee-only retirement advisors offer comprehensive financial planning services, encompassing all aspects of your retirement planning journey. They can help you assess your current financial situation, establish retirement goals, create a personalized savings plan, and strategize investment portfolios that align with your risk tolerance and desired outcomes. Their expertise can help you optimize your social security benefits, minimize taxes, and manage complex retirement accounts.

4.4 Ongoing Relationship and Support

Retirement planning is not a one-time event but an ongoing process. Fee-only advisors build long-term relationships with their clients, providing continuous support and guidance throughout their retirement journey. They can help you adapt your strategy as your goals and circumstances change, ensuring that you stay on track to meet your financial objectives.

Heading 5: How to Find a Fee-Only Retirement Advisor

Finding a fee-only retirement advisor requires diligence and research. It is essential to ensure that the advisor you choose aligns with your financial goals and values. Here are a few steps to help you find the right advisor:

5.1 Research and Compile a List

Search for fee-only retirement advisors in your area, utilizing online directories or referrals from trusted sources. Create a list of potential advisors based on their qualifications, experience, and client reviews.

5.2 Verify Credentials and Certifications

Check the credentials and certifications of the advisors on your list. Look for designations such as Certified Financial Planner (CFP) or Chartered Retirement Planning Counselor (CRPC), as these indicate a high level of expertise and professionalism in retirement planning.

5.3 Schedule Initial Consultations

Contact the shortlisted advisors and schedule initial consultations. Use this opportunity to assess their communication style, ask about their fee structure, and discuss your retirement goals. Pay attention to their listening skills and whether they provide personalized advice tailored to your needs.

5.4 Evaluate Costs and Services

Compare the costs and services offered by different advisors. Consider factors such as their investment strategies, financial planning tools, and ongoing support. Select an advisor whose pricing and services align with your budget and retirement planning requirements.

Heading 6: Take Action Today

Heading 6.1 Secure Your Financial Future

Planning for retirement requires careful consideration, and seeking professional advice can provide valuable insights and strategies. By engaging a fee-only retirement advisor, you can benefit from their objective recommendations, transparent pricing, and ongoing support. Take action today and start planning your retirement with confidence.

Heading 6.2 Enjoy a Stress-Free Retirement

A well-executed retirement plan can provide peace of mind, allowing you to enjoy your golden years without financial stress. With the guidance of a fee-only retirement advisor, you can develop a comprehensive financial strategy that meets your goals and maximizes your retirement savings. Embrace the benefits of fee-only retirement advice and embark on a journey to a financially secure and stress-free retirement.

Incorporating fee-only retirement advice into your retirement planning can provide numerous benefits. From objective recommendations to ongoing support, fee-only advisors can help you navigate the complexities of retirement planning and secure your financial future. Take the first step today and start planning your retirement with confidence.

Smart Tips For Finding

– Getting Started & Next Steps

The Importance of Regular Vehicle Repair Service and Maintenance

The Importance of Regular Vehicle Repair Service and Maintenance

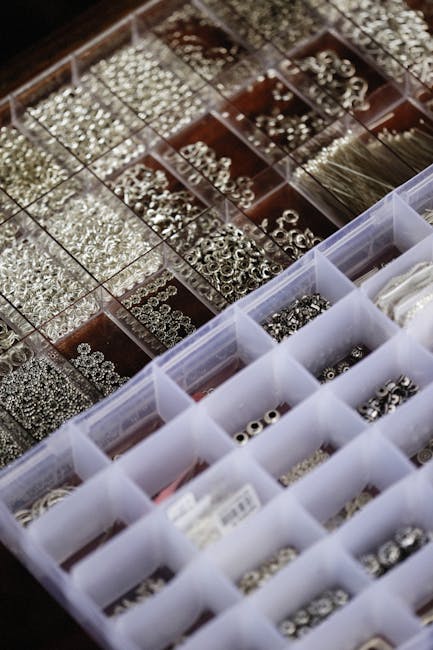

Heading: Finding the Perfect Jewelry at a Cleveland Store

Heading: Finding the Perfect Jewelry at a Cleveland Store Reinforcing Your Trench: An Essential Guide to Trench Reinforcement

Reinforcing Your Trench: An Essential Guide to Trench Reinforcement